Essential road safety and car maintenance tips for the December holidays

As families embark on their holiday travels, December and January typically see a sharp rise in road accidents, particularly during the busy periods of departure and return. Tragically, road deaths during this time are 25-30% higher than in other months. Increased traffic volumes, fatigue, and seasonal festivities further increase the risks, underscoring the critical importance of safe driving and proper car maintenance.

To help ensure a safer festive season, Ernest North, co-founder of digital insurance platform Naked, shares essential car maintenance and safe travel tips ahead of the holiday season.

1. Check your car’s roadworthiness

Keeping your car roadworthy will help reduce your chances of being in an accident and ensure a smoother claims experience. Here are a few things that you should check:

• Tyres: Visit a fitment centre to check your tyre tread depth. You should rotate your tyres every 10,000-12,000 km to ensure that your car doesn’t pull to one side.

• Lights and indicators: Test all indicators, brake lights, reverse lights, and headlights.

• Brakes: Get your brake pads checked if they have not been replaced in a while. Brake pads typically need replacement every 75,000 km, but some brake pads already need to be replaced after 25,000 kilometres.

2. Ensure all your paperwork is up to date

Your vehicle licence disc needs to be renewed once a year. Also, check that all potential drivers for your car have up-to-date driving licences. The licence needs to be renewed every five years, which includes an eye test.

3. Get the right insurance for cross-border trips

Heading beyond South Africa’s borders? Check if your car insurance covers travel in neighbouring countries. Most South African car insurance policies provide cover for damage to your own car in neighbouring countries across Southern Africa. However, some insurers might limit how long they cover your car when you’re out of the country.

In some neighbouring countries, you are legally required to have third-party insurance. This is to protect you from people making claims against you for bodily injury or property damage you might have caused. Most insurers don’t offer this cover once you cross the South African border, so be sure to buy this cover before you go. You can buy third-party liability cover at the border or Outdoor Warehouse.

Click here for a useful checklist of things you might need when you cross the border.

4. Cover your extras

If you’ve added costly accessories like roof racks, bullbars, or sound systems, update your insurance policy to include them.

Similarly, if you are travelling with expensive items like golf clubs, laptops, or jewellery, make sure they are insured for their full value by taking out single items insurance or specifying the items under your home contents insurance to ensure full coverage while travelling.

5. Be prepared and plan for emergencies

Save your insurer’s roadside emergency number on your phone so that you can quickly call for help if you have an accident or engine trouble. Naked customers can contact us via our app. Review accident protocols, such as this guide of dos and don’ts at the scene of an accident.

6. Never overload your vehicle

Exceeding your vehicle’s load limits can lead to tyre damage, reduced braking effectiveness, and compromised control. Stick to weight and size limits for roof racks and other storage equipment.

7. Stick to safe driving habits

Stay rested and have a good night’s sleep before a long trip. Take breaks or swap drivers on long journeys to prevent fatigue. While it is the season to be jolly, never drink and drive. Plan ahead and arrange alternative transport if needed, and always obey traffic laws.

8. Be alert and stay safe

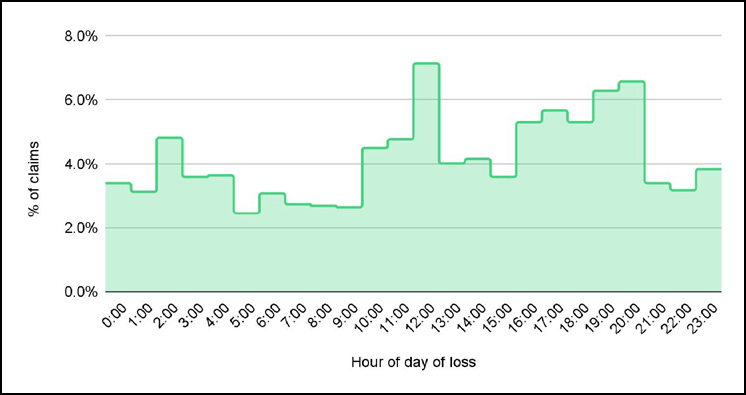

Our Naked claims stats show that it is a misconception that crime mostly happens at night and that we actually see a spike at midday. So, remember to remain alert and aware even while on holiday. Always try to park in secure, well-lit areas. And, double-check that your car is locked before walking away.

Car insurance claims linked to crime: time of loss

Source: Naked Insurance claims data

9. Pause your car insurance for non-driving days

If your car will stay parked at home or the airport during the holidays, use Naked’s CoverPause feature to pause accident cover for non-driving days, saving you up to 50% on premiums while remaining protected against theft, fire, and natural disasters.